Protect Your Home: How Weather Affects Property Insurance Claims: Insurance Lawyers share expert tips! ☔

As a homeowner, understanding the nuances of property insurance is vital for safeguarding your asset against unforeseen events. Weather patterns can wreak havoc on your property, leading to potential storm damage and insurance claims. Whether it’s roof damage from a storm or flooding due to heavy rain, being prepared is key to navigating insurance claims smoothly.

Why does being prepared for storm damage matter?

Homeowners often face the daunting task of dealing with insurance claims following bad weather conditions. Understanding the intricacies of property insurance can mean the difference between a seamless claims process or being crippled financially to repair your home.

Many property owners find themselves overwhelmed when it comes to navigating insurance claims, particularly in the aftermath of severe weather events. Whether it’s deciphering policy language, assessing damage accurately, or negotiating with insurance companies, the process can be complex and stressful, and we’re here to help you.

Here’s what we want to talk to you about:

- Common types of property damage caused by local weather patterns

- The role of insurance lawyers in property insurance claims

- Tips for filing successful insurance claims for roof damage and other storm damage related issues

- Strategies for maximizing your insurance claim payout

Types of Weather-Related Property Damage

Weather patterns such as heavy rainfall, hailstorms, hurricanes, and windstorms can inflict significant damage on properties. These natural phenomena are unpredictable and can cause a wide range of issues, from minor wear and tear to catastrophic destruction.

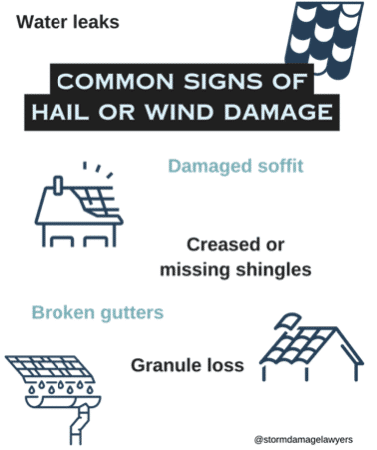

One of the most common types of weather-related property damage is roof damage. High winds, hail, and heavy rainfall can compromise the integrity of roofs, leading to leaks, missing shingles, or even structural collapse. Additionally, fallen trees or branches during storms can cause extensive damage to roofs and other parts of your property.

Flooding is another major concern for homeowners, especially if you live in flood-prone areas or regions prone to heavy rainfall. Excessive water accumulation can seep into the foundation, causing structural damage, mold growth, and electrical hazards. In severe cases, flooding can render a property uninhabitable and require extensive repairs.

Hailstorms occur year round throughout Texas, causing significant damage to properties. Hailstones can range in size from small pellets to large chunks of ice, and when they strike a property, they can dent or puncture roofs, siding, windows, and outdoor structures.

Tips for Filing Successful Storm Damage Insurance Claim

Filing a successful insurance claim for weather-related damage requires careful preparation and documentation. The following tips can help you navigate the claims process effectively:

- Document the Damage: Take photographs and videos of the damage to your property, including both interior and exterior areas. Make a detailed inventory of damaged items and keep receipts for any repairs or replacements.

- Review Your Policy: Familiarize yourself with your insurance policy, paying close attention to coverage limits, deductibles, and exclusions. Understand what types of weather-related damage are covered and what documentation is required for a claim.

- Notify Your Insurance Company: Contact your insurance company as soon as possible to report the damage and initiate the claims process, to avoid the delay to be used against the most beneficial result for you. Be prepared to provide detailed information about the incident, including the date, time, and cause of the damage.

Maximizing Your Storm Damage Insurance Claim Payout

To maximize your insurance claim payout, it’s essential to understand your policy coverage and rights as a policyholder. We recommend that homeowners do the following to ensure they receive fair compensation for their losses:

Know Your Coverage Limits: Review your insurance policy to understand the coverage limits and deductibles that apply to your claim. Be aware of any exclusions or limitations that may impact your payout.

Stormlex Tip: Insurance companies will often waive coverage for metal roofs. You can request to remove that Cosmetic Waiver in your policy so that your roof will be covered should a hailstorm damage your metal roof.

Hire Independent Adjusters or Insurance Lawyers: Consider hiring an independent adjuster or insurance lawyer to assess the damage to your property and provide an unbiased evaluation. Independent adjusters and insurance lawyers work for the policyholder (YOU!!) rather than the insurance company and can help ensure that all damages are properly documented and accounted for.

Document Additional Living Expenses: If your home is uninhabitable due to weather-related damage, keep track of any additional living expenses you incur, such as

- temporary lodging,

- meals, and

- transportation.

These expenses may be covered under your insurance policy and can be included in your claim. Remember, review your policy to check what you’re covered for!

What Texas Insurance Lawyers Can Do for You

When faced with the complexities of property insurance claims, many homeowners in San Antonio, Austin, Dallas and other Texas cities turn to insurance lawyers for guidance and representation.

Legal professionals such as the attorneys at Stormlex Law Group, specialize in navigating insurance policies and advocating for your best interests.

Photo by Luke Southern on Unsplash