Facing natural disasters is overwhelming for Texas homeowners, especially tornadoes.

When your roof is damaged, it’s crucial to ensure that your insurance claim is handled properly to cover the full extent of repairs. Unfortunately, insurance companies often deny, underpay, or delay claims, leaving you with unexpected costs and stress.

In Texas, homeowners frequently face challenges with insurance claims and their roof damaged property, particularly after severe weather events like tornadoes. We will explore how you can effectively manage your claim to avoid financial pitfalls:

- Recommended Steps After a Tornado

- Coverage Limits & Key Terms on Your Policy

- Common Insurance Tactics

- Recommendations for Future Tornado Preparedness

- Legal Support Benefits

Read on to ensure your tornado recovery is as smooth and financially secure as possible!

Certified Texas Roof Damage Attorney Recommended Steps to Take After a Tornado

Going through a natural disaster is not easy, especially if having to make an insurance claim. Weather can’t be controlled, but we can recommend the following steps to help recover after a tornado:

- Document all damage immediately. Take photos and videos of your property. Detailed documentation strengthens your claim. List all damaged items and provide their approximate value.

- Report the damage to your insurer as soon as possible. Keep a record of all communications with them. Prompt action is essential. The sooner you report the damage, the sooner the claims process can begin.

- After documenting the damage, secure your property. Prevent further damage by making temporary repairs if safe to do so.

- Keep receipts for any materials or services used for temporary repairs. These costs should be included in your insurance claim.

- Submit your claim with all supporting documentation. Clearly state the extent of the damage and the repairs needed. Be honest and thorough in your claim submission. Incomplete or inaccurate information can delay the process.

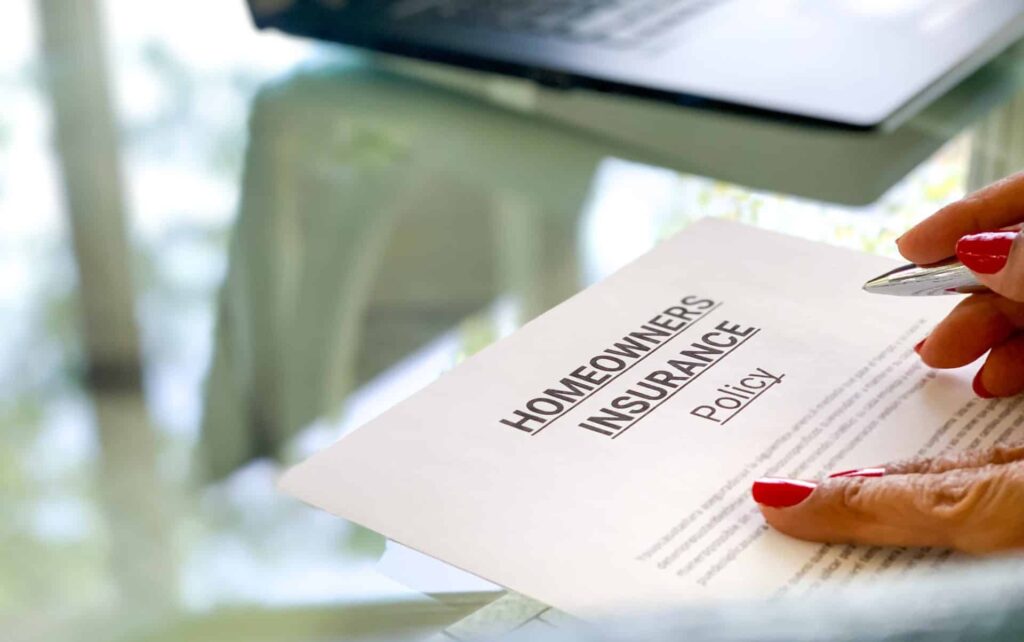

Coverage Limits and Exclusions explained by a Texas Roof Damage Attorney

We always talk about this, and how important it is to know what type of contract you have with your insurance. Review your insurance policy thoroughly. Understand the terms, coverage limits, and exclusions.

Knowing your policy helps you avoid surprises when filing a claim. Many homeowners overlook the details in their insurance policies. This oversight can lead to significant issues when filing a claim after tornado damage.

Every insurance policy has coverage limits. These limits cap the amount the insurer will pay for a covered loss. Exclusions are specific situations or types of damage that are not covered by your policy. Common exclusions include flood damage and certain types of roof damage.

Texas Insurance policies are required to cover tornado damages. Some policies have specific clauses for different types of storm and roof damage. Tornadoes are common in Texas, so having specific coverage for tornado damage is a need. We still recommend reviewing what your policy limits or exclusions may be in regard to tornado damage.

Knowing your coverage limits and exclusions is important. It helps you plan for any out-of-pocket expenses you might incur after a tornado.

Key Terms in Your Insurance Policy

Familiarize yourself with key terms in your policy. Terms like “actual cash value” and “replacement cost” can impact your claim amount.

“Actual cash value” covers the depreciated value of your property. “Replacement cost” covers the amount to replace your damaged property with new items.

Understanding these terms helps you know what to expect from your claim. A Texas roof damage attorney can explain these details and their implications for your claim.

Common Insurance Tactics

Insurance companies may try to underpay claims. They often do this by disputing the extent of the damage. They might delay the process, hoping you’ll accept a lower settlement. Be prepared to push back against these tactics.

Insurance adjusters may downplay the severity of the damage. They could argue that some damage was pre-existing or unrelated to the tornado.

One common tactic is to deny claims outright. Insurers might claim the damage isn’t covered under your policy terms. A Texas roof damage attorney can help challenge these denials. We understand the legal grounds for disputing unfair claim denials.

Insurance companies might also delay claims. They do this to pressure you into accepting a lower settlement. Delaying tactics can include requesting excessive documentation or continually re-evaluating your claim. This stalling can be frustrating and stressful.

If you believe your insurance company is acting in bad faith and taking unusual waiting times to process your claim or payment, you can reach out to a tornado damage attorney and also reach out to the TDI, the Texas Department of Insurance, and file a complaint against your insurance.

Preparing for Future Storms: Recommendations by a Texas Roof Damage Attorney

We’re going to keep this section short, since we’ve already covered this topic. Click the link at the end of this section to learn more about preparing and damage prevention tips. Preparation is key to minimizing tornado damage.

Regularly inspect and maintain your property to identify and fix potential vulnerabilities.

Have an emergency plan in place. Know what to do and who to contact if a tornado causes damage to your property.

Having the right insurance coverage is important as well. Review your policy regularly and update it as needed to ensure adequate protection.

Stormlex Tip: For more information on how to prevent tornado damage see our guide here.

Legal Support Benefits of a Texas Roof Damage Attorney

A Texas roof damage attorney can increase your chances of a fair settlement. At Stormlex Law Group one of our attorneys can negotiate on your behalf, saving you time and stress.

Having an expert on your side means you don’t have to navigate the complicated insurance process of a denied claim alone. With our extensive experience, we can help you secure the compensation you deserve, allowing you to focus on rebuilding and recovering from the disaster.

We have experience dealing with insurance companies and understand the tactics insurers use to minimize payouts. We advise you on the best course of action. This includes when to negotiate and when to pursue legal action.

We help maximize your settlement. We can help you understand additional coverages you might be entitled to. This can include temporary housing coverage. Dealing with storm damage is stressful, but you don’t have to face it alone. We can provide the support and expertise you need.

Navigating the aftermath of a tornado is challenging. Recognizing insurance tactics, and taking immediate action are crucial steps. A dedicated attorney can significantly ease the process and improve your settlement.

By understanding your policy, documenting damage, and seeking professional help, you can secure the compensation you deserve.

Stormlex Law Group

Join the Stormlex Alliance: a newsletter dedicated to educating you on insurance policy terms, tips for navigating the claims process, and weather-related prevention tips for your home or commercial property in Texas.

We throw in a weekly Star Wars meme for your entertainment and laughter, too! Who said we can’t have fun in your inbox?

If you reside in San Antonio, Dallas, Temple or another Texas city, this newsletter is a must-subscribe to reach your optimal Jedi master level of your insurance policy and your rights for a maximized claim payout!

Photo by Clay Banks on Unsplash