Property Damage Lawyer Can Help You: Snowfall Woes in Texas? 🌨️

Texas winters are often mild, but recent years have proven that heavy snowfall and freezing conditions can happen when you least expect them. For any property owner, this unusual weather isn’t just an inconvenience—it can result in costly property damage from roof collapses, burst pipes, and more. Unfortunately, dealing with insurance claims during these rare winter events can quickly become a stressful ordeal.

When unexpected snowstorms hit Texas, insurance companies may attempt to deny or underpay claims, leaving you stranded with repair bills. This is where working with a property damage lawyer becomes critical. Having someone in your corner who understands the insurance process can make all the difference in recovering what you’re owed and getting your home back to normal.

What You Will Learn 📝:

- How Texas snowfall leads to unexpected property damage

- Common winter claims and why insurers push back on payouts

- Tips for documenting damage and filing a strong insurance claim

- When to call a property damage lawyer to fight for your rights

Keep reading to learn how you can stay ahead of winter’s challenges and protect your property from unfair insurance practices.

Why Texas Properties Are Hit Hard by Snowstorms

Most Texas homes aren’t built for freezing temperatures and heavy snowfall. Homes and buildings up north are designed to handle the weight of ice and snow, but Texas properties are not.

When snow piles up on your roof or temperatures drop, parts of your home can take a hit. Pipes freeze, roofs sag, and water leaks through cracks. This kind of damage may be rare here, but it’s serious when it happens.

If you’re left wondering what to do next, a property damage lawyer can help you sort things out and make sense of your insurance claim.

Property Damage Lawyer Shares Common Types of Damage Seen After Texas Snowstorms

Winter storms can cause a variety of issues, and knowing what to look for helps you take action sooner. Here are the main types of damage homeowners and property managers deal with:

1. Roof Damage

Snow is heavier than you might think. When it collects on your roof, it can cause leaks or even a full collapse if your roof is weak.

2. Burst Pipes

This is one of the most common problems. When temperatures drop, pipes freeze, expand, and burst. Suddenly, you’re dealing with water everywhere—walls, floors, and ceilings.

3. Foundation Issues

The freeze-thaw cycle causes soil to shift around your home’s foundation. Over time, cracks form, which may weaken the structure.

4. Clogged Gutters and Ice Dams

When gutters freeze over, melting snow has nowhere to go. This leads to pooling water and roof leaks that creep inside your home.

5. HVAC and Heating System Problems

Texas heating systems just aren’t made for sustained freezing weather. HVAC systems can freeze up, leaving your home unheated.

If your insurance company gives you the runaround, an insurance dispute attorney from Stormlex Law Group can help get things back on track.

Property Damage Lawyer Explains Why Insurance Companies Deny Snowstorm Claims

Filing an insurance claim after a snowstorm doesn’t always go smoothly. Insurance companies sometimes deny, delay, or underpay claims for reasons that might seem unfair. Here are a few common excuses they use:

🛠️ It’s a Maintenance Issue: If you have a burst pipe, they might blame it on poor insulation or upkeep instead of the storm.

📑 Your Policy Doesn’t Cover It: Some policies exclude roof collapses or other snow-related damage.

⏰ You Took Too Long to Report: If you don’t file quickly, they may argue that you didn’t do enough to stop the damage.

💵 The Repair Costs Are Lower: Adjusters might undervalue the cost of repairs, leaving you to pay out of pocket.

If this happens to you, it’s important to push back. Working with a home insurance bad faith attorney can help you get a fair outcome.

Steps to Take Immediately After Winter Storm Damage: Tips from a Property Damage Lawyer

Taking quick action can make a big difference. Here’s what you should do as soon as you notice damage:

- Document Everything

Take photos and videos of the damage—roof, pipes, floors, walls—anything that’s been impacted. - Stop More Damage

Shut off your water supply if a pipe bursts. Cover roof leaks with tarps to limit further water intrusion. - File Your Claim Right Away

Don’t wait. Contact your insurance company as soon as possible to start the claims process. - Get Professional Estimates

Hire contractors to inspect the damage and give written estimates. These documents back up your claim. - Keep Receipts

Save receipts for temporary fixes, lodging, or other storm-related costs. You might get reimbursed later.

If your insurer starts dragging their feet, don’t hesitate to call a property damage lawyer from Stormlex Law Group for help.

Bad Faith Insurance Practices: What to Watch For

Insurance companies are supposed to process claims fairly. When they don’t, it’s called bad faith. A home insurance bad faith attorney can help you spot these tactics and take action.

Here are some signs your insurer might not be playing fair:

- They’re delaying your claim for no clear reason.

- They’re offering way less than it costs to repair the damage.

- They’re denying your claim without a real investigation.

If you feel like you’re getting the runaround, don’t just accept it. A property damage attorney can help hold your insurer accountable.

How a Property Damage Lawyer Can Help You

When your insurance company makes the claims process harder than it needs to be, it can feel overwhelming. That’s where a property damage lawyer comes in.

Here’s how they can help:

- Breaking Down Your Policy: They explain what’s covered, what’s not, and what your options are.

- Strengthening Your Claim: Lawyers gather evidence, professional estimates, and paperwork to support your case.

- Negotiating with the Insurer: If your claim gets denied or underpaid, they can push back on your behalf.

- Filing Legal Action if Needed: If the insurer still won’t budge, your lawyer can take the next steps to fight for fair treatment.

Preparing Your Home for the Next Winter Storm

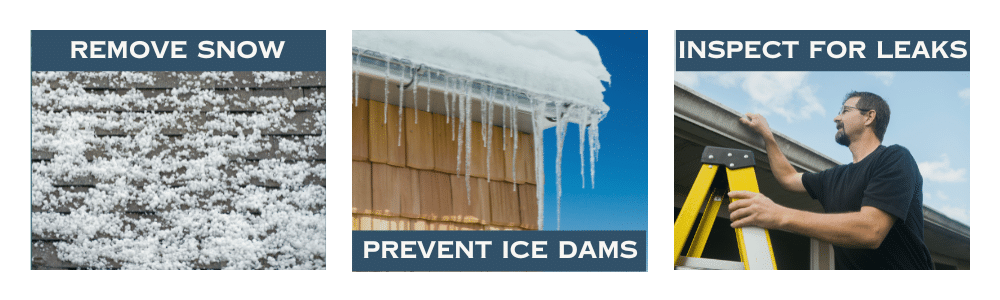

Winter storms might not happen often, but being ready can save you time, stress, and money down the line. Here are a few simple steps to prepare your home:

- Insulate Pipes

Cover exposed pipes with insulation to prevent freezing. - Inspect Your Roof

Check for weak spots, missing shingles, or other signs of wear before the next storm. - Clean Your Gutters

Make sure gutters are clear so water can flow freely. - Seal Windows and Doors

Drafty windows and doors let in cold air, which can freeze pipes and raise your heating bills. - Review Your Insurance Policy

Make sure you know what’s covered—and what isn’t—before winter arrives.

Protect Your Home with a Property Damage Lawyer

Take care of your home, document everything after a storm, and don’t hesitate to stand up for your rights. Snowstorms in Texas are rare, but they can cause real damage when they happen. From burst pipes to roof leaks, the repair costs can add up fast.

Dealing with insurance companies is often the hardest part. If your claim is delayed, denied, or underpaid, don’t settle for less than what you’re owed. A property damage lawyer can help you make sense of the process and fight for fair compensation.

Key Takeaways:

- Texas homes are vulnerable to snowstorm damage like roof leaks and burst pipes.

- Insurance claims can be tricky, with many claims getting denied or underpaid.

- Acting quickly and knowing your policy can help you protect your home.

- A property damage lawyer can help you navigate disputes and bad faith practices.

Stay informed, stay prepared, and know that help is available if you need it.

Stormlex Alliance Newsletter

Join the Stormlex Alliance: a newsletter dedicated to educating you on insurance policy terms, tips for navigating the claims process, and weather-related prevention tips for your home or commercial property in Texas.

We throw in a weekly Star Wars meme for your entertainment and laughter, too! Who said we can’t have fun in your inbox?

If you reside in San Antonio, Dallas, Austin or another city in Texas and have sustained hail, rain, or other weather related damage to your home,, this newsletter is a must-subscribe to reach your optimal Jedi master level of your insurance policy and your rights for a maximized claim payout!

Featured Photo by Ryunosuke Kikuno on Unsplash