Essential Tips from a Property Damage Insurance Lawyer

A property damage insurance lawyer understands that in the wake of a hurricane, homeowners face the daunting task of managing extensive property damage. From roof leaks to flooded interiors, the cleanup and repair process can be overwhelming and expensive. Understanding how to navigate the property damage insurance claim process is essential to avoid costly mistakes and ensure you get the compensation you deserve. With hurricanes and severe storms becoming more frequent, knowing how to protect your home and handle insurance claims effectively is more important than ever.

For Texas homeowners, the hurricane and hail seasons often lead to a flood of insurance claims. Many of these claims face delays or receive insufficient payments, leaving homeowners struggling to cover repair costs. The property damage insurance lawyers at Stormlex Law Group want to help you understand how you can manage your insurance claim, and share tips to make a significant difference in ensuring your property is properly repaired and protected.

What You’ll Learn:

- Assessing and Documenting Damage: The Essential First Step

- Filing Your Insurance Claim: How to Get Started

- Understanding Your Policy: What’s Covered and What’s Not

- Avoiding Common Pitfalls in the Claims Process

- Protecting Your Home: Steps to Take Before the Next Hurricane

In 2024, Hurricane Beryl caused significant damage in Houston, Texas, and many more surrounding counties. Hurricanes such as this one can leave behind a trail of destruction that’s both overwhelming and confusing. As a homeowner, dealing with the aftermath of a hurricane involves more than just cleaning up debris. It also means navigating the complex world of insurance claims. Understanding how to handle your property damage insurance claim effectively is crucial to ensure you receive the compensation you deserve.

Stormlex Law Group is here to walk you through the key steps to filing a property damage insurance claim after a hurricane. By the end, you’ll have a clear understanding of what to do, how to avoid common pitfalls, and how to protect yourself from underpayment or claim denial. Our goal is to provide you with valuable information so you can handle your claim with confidence.

Assessing and Documenting Damage: The Essential First Step

Begin with a Thorough Assessment

The very first step after a hurricane is to assess the damage to your property. Start by inspecting your home’s exterior. Look at your roof, siding, windows, and any other visible areas. Check for missing shingles, cracked windows, and other signs of damage. Next, move inside your home. Look for leaks, water damage, and any structural issues. This thorough assessment will help you understand the extent of the damage and how it may affect your insurance claim.

Document Everything Meticulously

Once you’ve assessed the damage, it’s crucial to document everything. Take detailed photographs and videos of all affected areas. Make sure to capture damage from multiple angles and include timestamps where possible. This documentation will be essential when filing your insurance claim, as it serves as evidence of the damage caused by the hurricane.

If you have previous photos or videos of your property before the hurricane, these can be invaluable for comparison. They help show the extent of the damage and support your claim for repairs. Proper documentation not only aids in the claims process but also helps prevent disputes with your insurance company.

What to Include in Your Documentation:

- Exterior Photos: Capture images of roof damage, siding, and windows.

- Interior Photos: Document any leaks, water damage, and structural issues.

- Videos: Use video to provide a more comprehensive view of the damage.

- Date Stamps: Ensure that all photos and videos are date-stamped to show when the damage occurred.

- Comparison Images: Include any pre-storm photos if available.

Filing Your Insurance Claim: Tips from a Property Damage Insurance Attorney

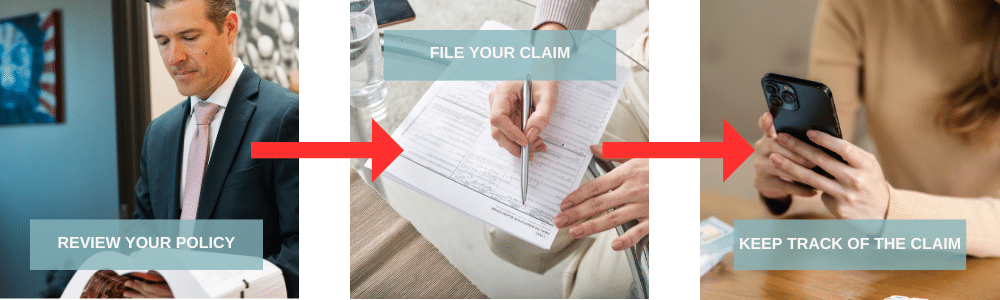

Review Your Insurance Policy

Before filing your claim, review your insurance policy carefully. Understanding your coverage is crucial. Look for information on what types of damage are covered, any exclusions, and your deductible amount. Policies can vary widely, so knowing what’s included will help you manage expectations and ensure you’re claiming the correct damages.

File Your Claim Promptly

Once you’re familiar with your policy, it’s time to file your claim. Most insurance companies require that you file your claim within a specific timeframe after the storm—typically 30 to 60 days. Filing promptly is essential to avoid potential issues with your claim.

When you file your claim, include all the documentation you’ve gathered. Attach photographs, videos, and any estimates from contractors or repair services. The more detailed and organized your claim, the smoother the process will be.

Keep Track of Your Claim’s Progress

After submitting your claim, it’s important to keep track of its progress. Regular follow-ups with your insurance company can help ensure your claim is being processed in a timely manner. If you encounter any delays or issues, document them and address them with your insurer promptly.

Key Steps to Filing:

- Review Coverage: Understand what your policy covers and any exclusions.

- File Promptly: Submit your claim within the required timeframe.

- Include Documentation: Attach all relevant photos, videos, and estimates.

- Follow-up: Regularly check the status of your claim and address any issues promptly.

Understanding Your Policy: What’s Covered and What’s Not

Know Your Coverage Limits

One of the biggest challenges homeowners face is understanding what their insurance policy covers. For instance, while policies cover wind damage, flood damage often requires a separate policy. Reviewing your policy will help you know what to expect and avoid surprises during the claims process.

You’ll also want to review what your coverage limits are for named hurricanes. If you feel that you’d need more coverage, communicate with your insurance company to upgrade your policy. Remember, your policy needs to meet your property’s needs!

Ask for Clarification

If you’re unsure about any aspects of your coverage, don’t hesitate to ask your insurance company for clarification. A Texas hurricane damage lawyer like the ones at Stormlex Law Group can also assist in reviewing your policy to ensure you understand the terms and coverage. Knowing the details of your policy can help you make informed decisions and avoid issues with your claim.

Typical Coverage Areas:

- Wind Damage: Includes damage from high winds, such as broken windows or roof damage.

- Water Damage: Covers damage from rain or water intrusion, but not necessarily flood damage.

- Structural Damage: Addresses issues with the home’s structure, such as foundation problems or wall damage.

- Personal Property: Covers damage to personal belongings inside the home.

Avoiding Common Pitfalls in the Claims Process

Don’t Delay Filing

One of the most common mistakes homeowners make is delaying their insurance claim. Delaying can lead to complications and may even result in denial. It’s important to file your claim as soon as possible after the hurricane to ensure that your insurer processes it in a timely manner.

Thorough Documentation is Key

Another frequent issue is inadequate documentation. Homeowners sometimes fail to document all the damage or provide incomplete information. To avoid this, ensure you capture all damage thoroughly and include detailed evidence. This will help support your claim and reduce the likelihood of disputes.

Be Cautious with Settlements

Insurance companies might offer a quick settlement, but it’s crucial to review it carefully. Sometimes initial offers are lower than what you’re entitled to. If you feel the settlement is too low, don’t hesitate to negotiate or request a detailed breakdown. Compare your local contractor estimate to what your insurance adjuster’s estimate came out to be.

Common Pitfalls to Avoid:

- Delaying Filing: File your claim as soon as possible to avoid complications.

- Incomplete Documentation: Document all damage thoroughly to support your claim.

- Accepting Low Settlements: Review and negotiate settlements to ensure they are fair.

If you would like to know more about some challenges you may face when filing a claim, and how to overcome them, our property damage insurance lawyer, Marco Flores, has made a video just for you:

What to Do if Your Claim is Denied or Underpaid

Understand the Denial Reason

If your claim is denied, the first step is to understand why. Insurance companies are required to provide a reason for denial, which should be detailed in the denial letter. Review the letter carefully to determine if there was a mistake or if additional information is needed.

Appeal the Decision

If you believe your claim was unfairly denied or underpaid, you can appeal the decision. Provide additional documentation or evidence to support your claim. An appeal can sometimes result in a revised settlement or acceptance of your claim.

Consider Legal Assistance if Necessary

While most claims issues can be resolved through appeals and negotiations, sometimes legal assistance may be necessary. A property damage insurance lawyer can help you understand the denial and guide you through the appeals process. However, seeking legal help should be a last resort after exhausting other options.

Steps After a Denial or Underpayment:

- Review Denial Letter: Understand the specific reason for denial.

- Appeal Decision: Submit additional evidence or documentation to support your claim.

- Seek Legal Help: Consider a property damage insurance lawyer only if needed.

Protecting Your Home: Steps to Take Before the Next Hurricane

Prepare Your Home

Preparing your home for future hurricanes can help reduce the risk of damage and simplify the claims process. Regular maintenance and proactive measures can prevent common issues that lead to larger problems during a storm.

Regular Inspections

Schedule regular inspections of your roof, siding, and foundation to identify and address potential issues before they become major problems. Maintaining your home in good condition can also strengthen your claims if damage does occur.

Storm-Ready Tips:

- Inspect Roof Regularly: Check for missing or damaged shingles.

- Trim Trees: Remove branches that could fall on your home.

- Secure Outdoor Items: Store or secure items that could become projectiles in high winds.

- Check for Leaks: Ensure there are no existing leaks or weaknesses in your home’s structure.

Navigating the property damage insurance claim process after a hurricane can be challenging, but with the right knowledge, you can manage it effectively. By assessing and documenting the damage thoroughly, understanding your insurance policy, and avoiding common pitfalls, you’ll be better prepared to handle your claim.

If you face issues like claim denial or underpayment, don’t hesitate to seek legal assistance from a property damage insurance lawyer like ours at Stormlex Law Group. And remember, protecting your home with regular maintenance can help minimize damage and simplify the claims process in the future.

By following these steps, you can ensure that your home is restored to its pre-storm condition and that you receive the compensation you’re entitled to.

Stormlex Alliance Newsletter

Join the Stormlex Alliance: a newsletter dedicated to educating you on insurance policy terms, tips for navigating the claims process, and weather-related prevention tips for your home or commercial property in Texas.

We throw in a weekly Star Wars meme for your entertainment and laughter, too! Who said we can’t have fun in your inbox?

If you reside in San Antonio, Dallas, Austin, or another city in Texas and have sustained hail, rain, or other weather-related damage to your home, this newsletter is a must-subscribe to reach your optimal Jedi master level of your insurance policy and your rights for a maximized claim payout!