Why Every Homeowner Needs a Property Damage Attorney This Winter

Winter storms in North Texas bring unique challenges to homeowners, from unexpected hail damage to costly repairs that can quickly add up. Protecting your home from these powerful weather events is more important than ever, and a property damage attorney can be your greatest ally. Our legal experts help ensure that insurance claims are paid fairly and quickly. Especially as you focus in on your holiday planning. 🎄

Without proper coverage, homeowners often face underpaid claims or coverage denials, leaving them with substantial out-of-pocket expenses. A property damage attorney advocates insurance education. We help you learn how to avoid common pitfalls, understand your policy, and maximize your claim after a winter storm hits. Stormlex Law Group is sharing everything you need to know to prepare and protect your home for the season ahead. ❄️

What You’ll Learn:

- How Texas winter storms impact your home

- Why insurance claims are often denied after hail storms

- How a property damage attorney can help with winter storm claims

- Essential steps to winter-proof your home and maximize coverage

What’s at Stake for Homeowners After a Winter Storm?

Winter storms can bring a range of problems for homeowners, from roof damage to water leaks, broken windows, and even structural damage. Texas is no stranger to severe hailstorms, and the risk of property damage is high during the colder months. When storms cause damage, your insurance company should step in to help, but the claims process doesn’t always result in a payout.

That’s where a property damage attorney comes in. Working with a property damage attorney can help you recover your claim. Whether you’re dealing with a denied or underpaid claim, a property damage attorney will fight for a fair payout.

How a Property Damage Attorney Can Help After a Winter Storm

When you face significant damage from a winter storm, working with a property damage attorney can make a big difference in how your claim is handled. Your insurance company may not always offer the full amount you’re entitled to. An attorney can help you understand your policy, negotiate with the insurance adjuster, and even take your case to court if necessary.

Even if your claim is straightforward, a property damage attorney can still offer valuable insight into what steps you should take to avoid potential delays or complications. By understanding the legal side of things, you’ll be better prepared to handle your insurance claim smoothly and get the compensation you need for repairs.

Common Winter Storm Damages Homeowners Face

Winter storms can bring various types of damage. As a homeowner, it’s helpful to know what to expect so you can act quickly if any of these issues arise.

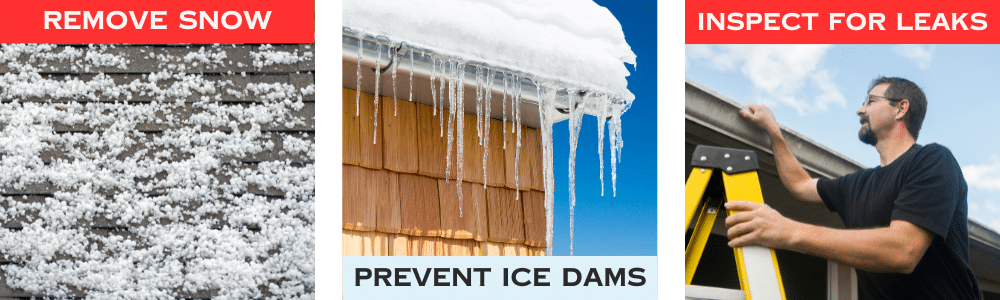

- Roof Damage: Hail, ice, and strong winds can tear off shingles, cause cracks, or even lead to a collapsed roof. A roof damage insurance claim lawyer can work with your roofer to ensure your insurance covers the damages.

- Frozen Pipes: When temperatures drop below freezing, water in pipes can freeze, causing them to burst and flood your home. A property damage attorney from Stormlex Law Group highly recommends reviewing the limits and exclusions in your policy to ensure what coverage you have for pipes bursting.

- Window and Door Damage: Hail or high winds can break windows or doors, leaving your home vulnerable to further damage. Your insurance claim attorney can help you determine if a claim dispute is needed based on your policy and the damages sustained.

Knowing these common damages helps you recognize the problem early and take steps to prevent further harm. Some damages will do fine to mitigate or repair on your own, but substantial damages should be done with the help of your insurance coverage.

The Importance of Acting Fast After Storm Damage

After a winter storm, time is of the essence. Most insurance policies require you to file a claim within a certain period, so it’s important to act quickly. Delaying your claim can lead to complications, and in some cases, your insurer may deny it entirely.

Asking for your policy (the full policy) ahead of time or when you need to file a claim is a great first step. Your insurance policy contains your timeline for filing, your responsibilities, and more. They’ll also ensure that the insurance company doesn’t take advantage of your lack of experience. The sooner you act, the more likely you are to get the compensation you deserve.

How a Property Damage Attorney Can Assist with Your Insurance Claim

Insurance claims can be confusing, especially when it comes to property damage. If you’ve never filed a claim before, it’s easy to miss important steps or overlook critical details.

A property damage attorney recommends being as proactive as possible when it comes to filing a claim. Be sure to submit the proper documentation, such as photographs of the damage. Send in repair estimates, and any other paperwork requested. Your insurance company will also work directly with your contractor to ensure your claim is processed fairly and quickly. If your claim is denied or undervalued, a property damage attorney can help you challenge the decision and ensure you get a fair settlement.

How to Winter-Proof Your Home and Prevent Future Damage

While it’s important to deal with storm damage after it happens, you can also take steps to prevent damage in the future. Here are some simple ways to winter-proof your home:

- Check the Roof Regularly: Look for any loose shingles or potential leaks. If you notice any issues, repair them before a storm hits.

- Seal Gaps and Cracks: Inspect windows, doors, and walls for any gaps that could let cold air in or allow water to seep through.

- Insulate Pipes: Insulate exposed pipes in areas like attics or basements to prevent freezing.

These preventive measures can help minimize the impact of winter storms and protect your home from the worst of the damage.

What to Do If Your Insurance Claim Is Denied

Even with the best precautions, sometimes insurance claims get denied or underpaid. If your insurance company denies your claim, don’t panic. A home damage insurance claim lawyer can help you review the details of your policy and determine why the claim was denied.

An attorney will help you understand your rights and walk you through the process of appealing the denial. This might involve gathering more evidence or even negotiating with your insurance company. By having a lawyer by your side, you’ll have the best chance of overturning the decision and getting the payout you need.

Why Winter Storm Insurance Claims Can Be Challenging

Winter storm insurance claims are often more complicated than they seem. Insurance companies can be quick to minimize claims or point to exclusions in your policy to limit their liability. Some common challenges include:

- Policy Exclusions: Certain types of damage may not be covered, such as flooding or water damage due to improper maintenance.

- Underpayment of Claims: Insurance adjusters may underestimate the cost of repairs, leaving you with an incomplete settlement.

- Delayed Claims: If you don’t act quickly, your insurer may delay or deny your claim outright.

A property damage attorney will help you navigate these challenges and make sure your claim is fully compensated. They understand the tactics insurance companies use to minimize claims and can help you get the fair payout you deserve.

Contact Stormlex Law Group

Texas residents in cities like San Antonio, Dallas, and Austin often experience significant property damage due to frequent, violent storms. In your time of need and stress, you expect the insurance company to show up for you and your claim. That’s not always the case.

Negotiating with insurance companies can be stressful, but Stormlex Law Group knows how essential it is to protect your rights. Our insurance lawyers are prepared to present your case clearly and persuasively, using evidence and documentation to support your arguments.

Facing a denied insurance claim can be overwhelming, but understanding your rights and seeking legal help can improve your chances. If you are currently dealing with a denied claim, give us a call at 877-890-6372 or send us an email at info@stormlex.com

Featured Photo by Kyle DeSantis on Unsplash