Property Damage Lawyer Provides Legal Insight for Homeowners

When disaster strikes, providing proof of loss is one of your first steps in filing an insurance claim. After a hurricane or hailstorm, homeowners are often left scrambling to document property damage and pick up the pieces. Without the right evidence, your claim may face delays, underpayment, or even outright denial. This is where a property damage lawyer becomes invaluable, helping you navigate the complexities of filing your claim and ensuring your losses are fully compensated.

Proof of loss serves as the foundation of your insurance claim. It’s not just about showing that damage occurred—insurers require detailed documentation, including photos, estimates, and inventories, to process claims properly. Homeowners may struggle with compiling the necessary information, especially while managing the emotional and financial toll of storm damage. Failing to provide proof can severely impact the outcome of your claim, leading to unfairly low settlements.

The attorneys at Stormlex Law Group have put together this free guide to help you gather and present the right documentation for your claim. This ensures that your claim reflects the true extent of your losses. Whether you’re dealing with a denied claim or want to prevent issues from the start, a lawyer’s guidance can mean the difference between a smooth claims process and months of hassle.

What You Will Learn:

- Why proof of loss is crucial after hurricanes and hailstorms

- Tips for gathering evidence and documentation

- How a property damage lawyer can assist when claims get complicated

Why Proof of Loss Is Critical for Your Insurance Claim

When you’re faced with storm damage—whether from a hurricane, hailstorm, or other natural disasters—one of the first and most critical steps is submitting a proof of loss to your insurance company. This documentation not only outlines the damage you’ve suffered but also serves as your formal request for compensation. Without an accurate, thorough proof of loss, your insurance company has little incentive to process your claim fairly.

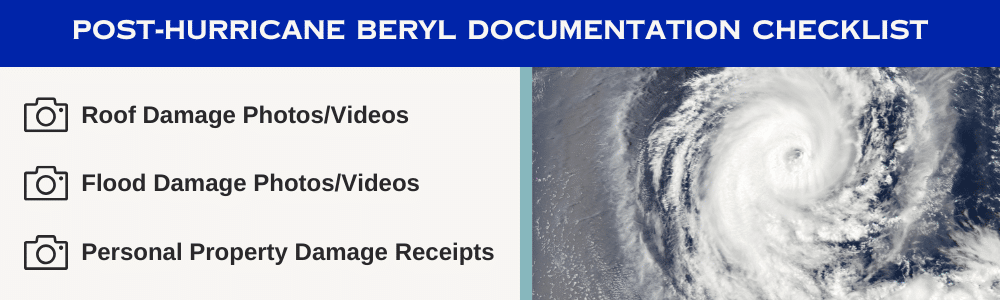

The importance of proof of loss cannot be overstated. Many homeowners mistakenly believe that simply reporting the damage is enough, but insurers require detailed documentation to assess the validity and extent of your claim. This is especially true in the aftermath of large-scale disasters like Hurricane Beryl in Houston, Texas, where the volume of claims skyrockets and insurers become increasingly stringent. A property damage lawyer from Stormlex Law Group recommends taking a checklist approach to documenting and ensuring your claim has the strongest foundation possible.

Failing to submit a complete and accurate proof of loss can lead to long delays, underpayment, or even outright denial of your claim. Insurers are experts at identifying gaps in documentation or vague claims, which they may use as justification to offer less than you deserve. Homeowners frequently miss out on full compensation simply because their proof of loss wasn’t detailed enough. This is where the expertise of an insurance claim lawyer comes into play, helping you avoid common mistakes and ensure that your claim is properly supported.

What Is a Proof of Loss?

A proof of loss is a formal statement provided to your insurer that outlines the damages you have incurred and the amount you are claiming. It typically includes key details such as:

- The nature and cause of the damage (e.g., wind, hail, flooding)

- An itemized list of damaged or lost property, including photos or video evidence

- Repair estimates or receipts for temporary repairs (Stormlex Tip: Mitigating your damages is your responsibility and part of your insurance policy!)

- Any additional living expenses if you’ve had to vacate your home

- Personal property losses (for example, electronics, furniture, clothing)

This documentation acts as the backbone of your insurance claim, and insurers rely on it to determine the validity and extent of your losses. Many policies require you to submit a proof of loss within a specific time frame—usually within 30 to 60 days after the damage occurs.

Why Proof of Loss is Not Enough: Insight from a Property Damage Lawyer

While gathering and submitting a proof of loss might sound straightforward, the reality is that this process can be complicated, especially if you’re unfamiliar with the nuances of your insurance policy. Many homeowners assume that their insurer will guide them through the process, but this isn’t always the case. In fact, insurers may use vague language in your policy or fail to inform you of key requirements, setting you up for mistakes. The experienced property damage lawyers at Stormlex Law Group know what traps and tactics the insurance companies utilize. We are here to ensure you receive your full compensation.

Insurers often require very specific documentation to substantiate a claim, and they might reject claims based on technicalities like improper filing or missing information. A property damage lawyer can review your claim after it has been denied or underpaid to ensure that all necessary documentation is in order. This is particularly helpful after events like hurricanes or hailstorms, where damage is widespread and insurers may look for reasons to minimize payouts.

Moreover, if your insurer disputes the amount or validity of your claim, a property damage lawyer can step in to negotiate on your behalf. We understand how insurers operate and can help counteract tactics designed to delay or deny payment. If the insurer continues to act in bad faith, Stormlex Law Group may escalate the issue, involving an insurance litigation attorney to take legal action if necessary.

How to Gather Evidence for Proof of Loss

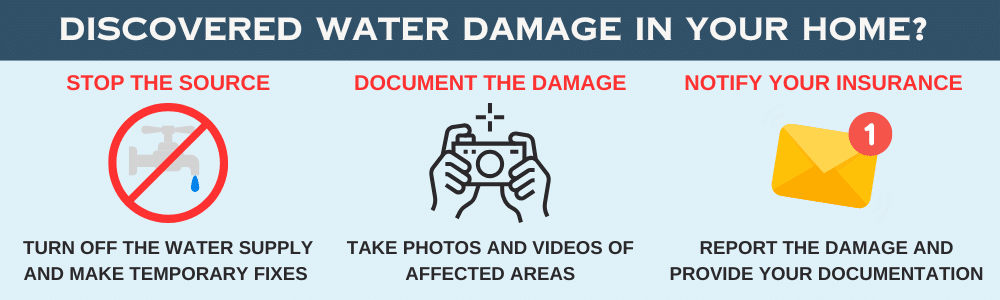

The proof of loss process involves gathering adequate evidence to support your claim. The more comprehensive your documentation, the stronger your case will be. Insurers need to see clear evidence of the damage, its cause, and the cost to repair or replace damaged property. Below are some steps to help you gather the right evidence for your proof of loss:

1. Take Photos and Videos Immediately

After the storm passes and it is safe to do so, begin by documenting the damage with photos and videos. Be thorough—take pictures from multiple angles, and ensure you capture every affected area. This includes both the exterior of your home (like the roof, windows, and siding) and the interior (walls, ceilings, floors, and personal belongings). Keep a timestamp on all photos and videos, as this can help prove the damage occurred during the storm.

2. Keep All Receipts and Estimates

If you have to make any temporary repairs to protect your home from further damage, keep all receipts related to these costs. For example, if you need to install a tarp on your roof to prevent leaks, the cost of materials and labor should be documented. Additionally, obtain estimates from licensed contractors for any major repairs that need to be made. A detailed, itemized estimate can provide a clear picture of the extent of the damage.

3. Inventory Personal Property Losses

For many homeowners, personal belongings like furniture, electronics, and clothing can be among the most significant losses after a hurricane or hailstorm. Make a detailed inventory of these items, including their condition before the storm, estimated value, and any receipts or records of purchase if available. Photos of these items in their damaged state can further support your claim.

How a Property Damage Lawyer Helps Strengthen Your Claim

Having an experienced property damage lawyer from Stormlex Law Group by your side can significantly improve the likelihood of your claim being fairly compensated. Here’s how wecan assist throughout the process:

1. Ensuring Comprehensive Documentation

A lawyer can help ensure that your proof of loss is thorough and complies with your insurance policy’s requirements. We can review all documentation for your claim, ensuring nothing was overlooked or inadequately supported. This attention to detail can drastically support your dispute for your claim denial or underpayment.

2. Avoiding Common Mistakes

Homeowners often make mistakes that weaken their proof of loss without even realizing it. Missing deadlines, failing to provide sufficient evidence, or underestimating repair costs are all common errors. A property damage lawyer knows the ins and outs of the claims process and share several free articles to help you avoid these pitfalls.

3. Communicating With Insurers

Dealing with insurance companies can be frustrating, especially when your claim seems to be moving slowly or you’re receiving vague responses. A property damage lawyer can act as your advocate, communicating directly with the insurer when you decide to dispute your claim. This can speed up the legal process and ensure that the insurer takes your claim seriously.

4. Negotiating Settlements

In many cases, the initial settlement offer from the insurer may not be sufficient to cover the full extent of your losses. A property damage lawyer can negotiate with the insurer to ensure you receive a fair settlement. If the insurer refuses to budge, a property damage lawyer can escalate the claim, potentially filing a lawsuit if necessary.

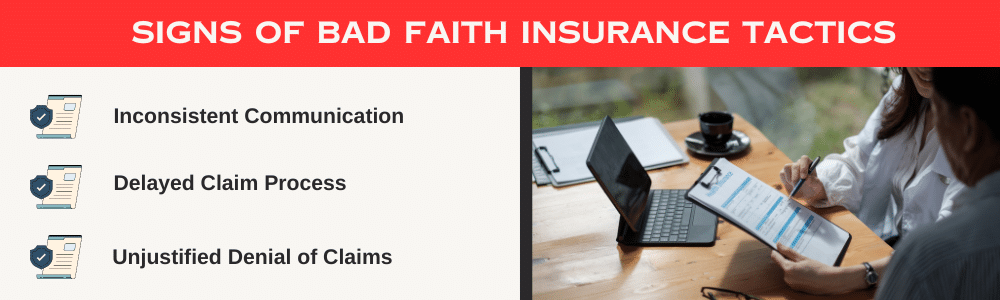

5. Addressing Bad Faith Tactics

If your insurer is acting in bad faith—delaying your claim without reason, offering unreasonably low settlements, or denying your claim without proper cause—a property damage lawyer can take action. They can help you file a bad faith insurance claim and hold the insurer accountable for unfair practices.

How to Avoid Common Mistakes in the Proof of Loss Process

When dealing with an insurance claim, the smallest mistakes can lead to big consequences. Here are some of the most common errors homeowners make in the proof of loss process and how to avoid them:

1. Missing the Submission Deadline

Most insurance policies have strict timelines for when a proof of loss must be submitted, often within 30 to 60 days after the damage occurs. Missing this deadline can result in your claim being denied outright.

2. Providing Incomplete or Vague Documentation

One of the most common reasons claims are denied or underpaid is that the proof of loss doesn’t include enough detail. For example, submitting a general estimate for repairs without a specific breakdown of costs can lead the insurer to question the claim’s validity.

3. Overlooking Small Damages

It’s easy to focus on obvious damage, like roof holes or broken windows, but smaller damages can quickly add up. Overlooking things like water damage in the walls or flooring, damaged appliances, or mold can reduce your overall compensation. A property damage lawyer can thoroughly assess your property to ensure nothing is missed, and we offer free evaluations!

When to Seek Legal Help if Your Claim Is Denied or Underpaid

Many homeowners don’t realize that they can seek legal help when their claim is denied or underpaid. It’s never too late to get help. Here’s what to do if you find yourself in this situation:

1. Review the Denial Reason

Your insurer is required to provide a reason for denying your claim. In some cases, this might be due to missing documentation or an error in your proof of loss. Stormlex Law Group can help determine if your claim can be disputed further and provide the best course of action.

2. Resubmit Your Claim

If the denial was due to incomplete documentation, you may be able to resubmit your claim with the necessary corrections.

3. File an Appeal or Lawsuit

If your insurer refuses to cooperate or acts in bad faith, a property damage lawyer can escalate the claim legally. At this stage, an insurance litigation attorney from Stormlex Law Group may become involved to represent your interests in court.

It’s important to remember that a denial doesn’t mean the end of your claim. With the help of a property damage lawyer, you can fight for the compensation you deserve.

Follow us on Youtube:

Stormlex Law Group is sharing weekly videos that break down insurance policy terms and why they matter, tips for navigating the claims process more effectively, and all things Texas insurance law related.

If you reside in San Antonio, Dallas, Austin or another Texas city, be sure to give us a follow so that you know your property rights as a policyholder in Texas!

Featured Photo by Yiran Yang on Unsplash