Safeguard Your Assets: How an Insurance Litigation Attorney Can Clarify Property Damage Policies

Why Commercial Property Managers Need an Insurance Litigation Attorney

As a commercial property manager, you have a lot on your plate. From managing tenants to maintaining the property, something is always demanding your attention. One of your most important, but often overlooked, responsibilities is ensuring that your property’s insurance coverage is solid. When disaster strikes—whether it’s a hurricane, hailstorm, or any other major weather event—your insurance policy should cover the damages. But insurance claims don’t always turn out as expected.

This is where an insurance litigation attorney can help. If you’re dealing with a denied claim or a payout that doesn’t cover the full cost of repairs, an attorney can assist. They will interpret your insurance policy, make sure the terms are followed, and guide you through the claims process to ensure you’re getting what you deserve. Having a lawyer on your side can give you peace of mind, knowing that your claim is in good hands.

An insurance litigation attorney can break down the confusing parts of your policy and explain exactly what’s covered and what’s not. If your insurance company refuses to pay out or undervalues your damages, your lawyer can help you challenge their decisions. They’ll make sure you don’t pay out of pocket for repairs that your insurance policy should have covered.

How Insurance Disputes Affect Commercial Property Managers

As a property manager, one of your worst nightmares is dealing with an insurance claim that gets delayed or denied. Unfortunately, this happens more often than you might think. Insurers may try to avoid paying out by claiming the damage doesn’t fall within the coverage or is less severe than it actually is. This can leave you in a tough spot, especially when repairs are expensive, and you’re left trying to cover the costs yourself.

When this happens, an insurance litigation attorney becomes key. A lawyer will review the fine print of your policy, challenge the insurer’s decision, and help you get the compensation you’re entitled to. Without legal help, you may end up fighting an insurance company with more resources and experience on their side. A property damage lawyer can level the playing field and give you a fighting chance.

Even when your claim is accepted, the payout might not be enough to cover all the necessary repairs. Insurers often offer a settlement far below what’s needed to fix the damage properly. That’s where a prroperty damage insurance claim attorney can step in to negotiate on your behalf and ensure the amount you’re offered reflects the full extent of the damage.

Understanding the Claims Process with the Help of an Insurance Litigation Attorney

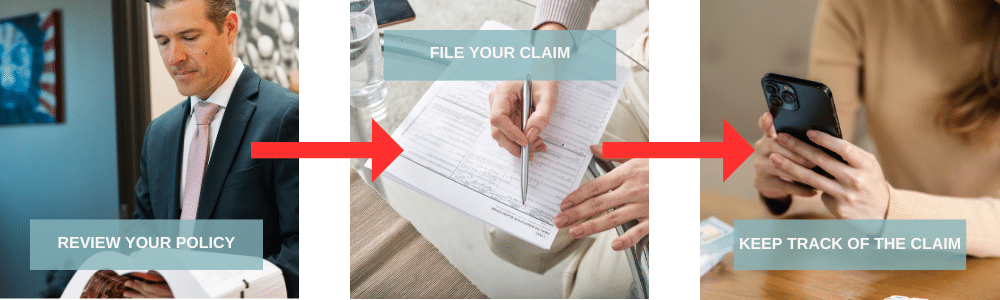

Filing an insurance claim for storm damage can overwhelm you, especially if you don’t know the ins and outs of your policy. When disaster strikes, you must know exactly what your insurance covers and the steps you need to take to get compensated. The last thing you want is to submit a claim, only to find out later that you missed a deadline or didn’t include the right documentation.

An insurance claim attorney can guide you through the insurance claim dispute process. They can help you understand your policy, explain any confusing clauses, and let you know if you should be doing anything differently. In fact, having an insurance litigation attorney on your side can help you avoid common mistakes that might delay your claim or reduce the payout you receive.

Part of the claims process includes making sure you document all the damage well. After a storm, you must take photos, make detailed notes, and keep records of all repairs. Insurance companies will want proof of the damage before they approve your claim. A property damage lawyer will help you make sure you’ve got all the documentation you need, so you’re in the best position to receive a fair payout.

Why Texas Property Owners Need to Know Their Rights

In Texas, property managers are no strangers to severe weather, especially during hurricane and hail seasons. Hurricanes can cause massive damage, and hailstorms can leave roofs, windows, and siding in need of serious repairs. Unfortunately, when it comes to filing claims, many property managers face a tough battle with their insurance company. The truth is, insurance companies may try to get out of paying by undervaluing the damage, denying claims, or offering less money than necessary.

That’s why property managers in Texas need an insurance litigation attorney on their side. When an insurance company fails to meet its obligations, an attorney can help you take action. They’ll review your insurance policy and make sure your claim gets handled fairly. If your insurance company tries to avoid paying what they owe, your lawyer can challenge their decision and get you the right payout.

By involving a lawyer, you can avoid costly mistakes and ensure you’re getting what you deserve. Texas property owners shouldn’t have to pay out of pocket for repairs that insurance should cover. Whether it’s roof damage or structural issues caused by a storm, an attorney ensures you don’t face unexpected repair costs.

The Role of an Insurance Litigation Attorney in Hail and Hurricane Claims

When you deal with storm damage, especially from hurricanes or hailstorms, the aftermath can overwhelm you. In Texas, these storms frequently occur, and they cause extensive damage. As a property manager, you need to ensure the damage gets repaired. Make sure that you file your insurance claim properly. But insurance claims for storm damage can be tricky, and that’s where an insurance litigation attorney comes in.

After a storm, your insurance company may try to downplay the severity of the damage, claiming it’s not as bad as you say. They might also try to limit their payout by offering a settlement that doesn’t reflect the true cost of repairs. With the help of a property damage insurance claim attorney, you can make sure your claim gets properly evaluated and that you don’t get shortchanged.

An insurance litigation attorney can help you ensure all the damage is covered. That includes everything from roof damage to structural issues, even if they’re less obvious. Without an attorney, you may miss some damages, but a lawyer ensures you account for everything. This helps maximize your payout and guarantees proper repairs.

Protecting Your Property and Investment

For commercial property managers, protecting your building is a top priority. After a storm or natural disaster, you must file an insurance claim to get the repairs you need. The insurance process can be overwhelming. Insurance companies don’t make it easy for you to navigate. That’s why having an insurance litigation attorney by your side matters.

Whether you’re dealing with a hurricane, hailstorm, or other storm damage, an attorney can help. They’ll make sure your insurer follows the policy terms, help you get a fair payout, and fight any unfair denials or underpayments. By involving an attorney early on, you protect your investment and avoid the risk of paying for repairs yourself.

Don’t let insurance companies take advantage of you. With the right legal guidance, you can ensure that you fully repair your property and make your insurance company meet its obligations.

Stormlex Alliance Newsletter

Join the Stormlex Alliance! Our newsletter educates you on insurance policy terms, tips for navigating the claims process, and weather-related prevention tips. Whether you own a home or commercial property, our resources will visit your inbox weekly.

We throw in a weekly Star Wars meme for your entertainment and laughter, too! Who said we can’t have fun in your inbox?

Reside in San Antonio, Dallas, Austin or another city in Texas? Sustaining hail, rain, or other weather related damage to your home? This newsletter is a must-subscribe to reach your optimal Jedi master level of your insurance policy!

Featured Photo by Jeremy Doddridge on Unsplash