Insurance Claim Tips Every Business Owner Needs to Know

When hurricane or hail seasons come to Houston, Corpus Christi, and other Texas cities, commercial property owners need to be prepared for the potential damage. These storms can cause structural, roof, and other damages to your property and business. Beyond the physical repairs, dealing with your insurance company can be one of the most stressful parts of the recovery process. Ensuring that your claim is properly handled is crucial to protecting your business. This is where working with an experienced insurance claim attorney at Stormlex Law Group can make all the difference. Letting an expert help you navigate negotiations can save you time, money, and future headaches.

Texas business owners are no strangers to tough insurance battles after storm damage. Too often, claims are delayed, underpaid, or outright denied. We’re here to guide you on how to handle these challenges to secure the payout your business deserves.

What You’ll Learn:

- Essential steps for negotiating with your insurance company

- Common mistakes to avoid that could hurt your claim

- When to involve an insurance claim attorney to protect your rights

- Tips to speed up the claims process after hurricane or hail damage

The Dos and Don’ts of Negotiating with Your Insurance Company

When your commercial property suffers storm damage, dealing with your insurance company can be overwhelming. The process of filing a claim and securing a fair payout requires careful navigation. To make sure you avoid common mistakes, it’s important to know the dos and don’ts of negotiating with your insurer. A knowledgeable insurance claim attorney can provide valuable support. Here are the key steps to help Texas business owners get the settlements they deserve after hurricane or hail damage.

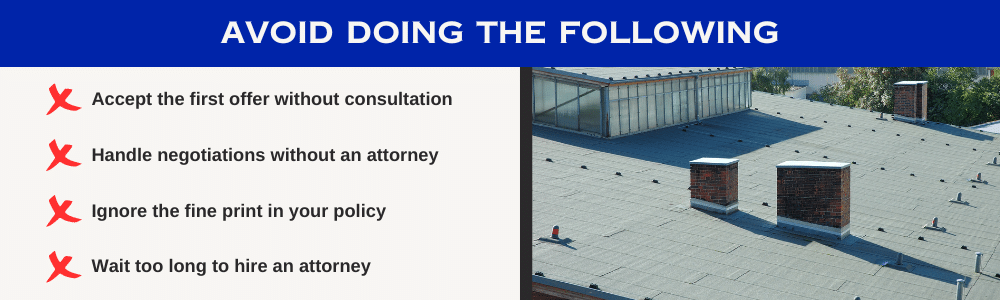

Let’s Discuss the Don’ts:

Don’t: Accept the First Offer Without Consulting an Insurance Claim Attorney

Many commercial property owners make the mistake of accepting the first settlement offer from their insurer. Insurance companies frequently make low initial offers to minimize their payouts. These offers often don’t reflect the true cost of repairing or replacing damaged property.

Before agreeing to any settlement, consult with an experienced insurance claim attorney. Attorneys can review your claim and evaluate whether the insurer’s offer is fair. Often, attorneys can negotiate for a higher payout that covers the full extent of your losses. This simple step can prevent significant financial losses for your business.

Remember, accepting the first offer locks you into that amount. You won’t be able to reopen the claim later for more compensation. It’s better to be cautious and ensure the offer is sufficient before signing anything.

Don’t: Handle Complex Negotiations Without a Roof Damage Lawyer

Roof damage claims are often more complicated than they appear. If your commercial building’s roof is damaged during a storm, repair costs can be significant. Insurance companies may try to argue that the roof damage was pre-existing, or they may downplay the severity of the damage. Without legal help, you could end up with a settlement far below what’s needed to repair your roof properly.

Working with a roof damage lawyer is critical in these situations. Roof damage can be difficult to evaluate, and insurers often use this to their advantage. A lawyer will work with roofing experts to ensure that the full extent of the damage is properly documented. This can help avoid disputes and ensure you receive fair compensation.

Additionally, insurance companies sometimes classify roof damage as cosmetic rather than structural. This can drastically reduce the amount they are willing to pay. A Texas claim attorney understands how to challenge these classifications. They can argue for a payout that reflects the true cost of repairs.

Don’t: Ignore the Fine Print in Your Policy

Insurance policies are filled with complex language that can be hard to understand. But failing to read and understand your policy can lead to problems when it’s time to file a claim. Some policies include exclusions or limitations that may affect your ability to recover damages. For example, certain types of roof damage may not be covered under standard commercial policies.

A Texas claim attorney can review your policy and explain any limitations or exclusions. There are several free resources on our Stormlex Blog to ensure that you know how to file correctly and in line with your policy’s requirements. This reduces the risk of your claim being denied due to a technicality.

Don’t assume that your insurer will explain everything to you. The fine print often favors the insurance company, so having an attorney review your policy before filing a claim is a wise move.

Don’t: Wait Too Long to Hire a Property Damage Attorney

Hiring an attorney after storm damage can seem like an unnecessary expense. However, in Texas, your insurance company is required to cover our fees, so working with an attorney will cost you no out of pocket expense. The earlier you involve a property damage attorney, the stronger your case will be.

Attorneys can help ensure that all deadlines are met, documentation is properly prepared, and negotiations are handled effectively. They can also advise you on when to accept a settlement or when to keep pushing for more compensation. Waiting too long to hire an attorney may leave you stuck with an unfair settlement that could have been avoided.

Hiring an attorney early in the process also helps reduce stress. You won’t have to worry about missing important steps or getting taken advantage of by your insurance company. Your attorney will handle these details while you focus on running your business.

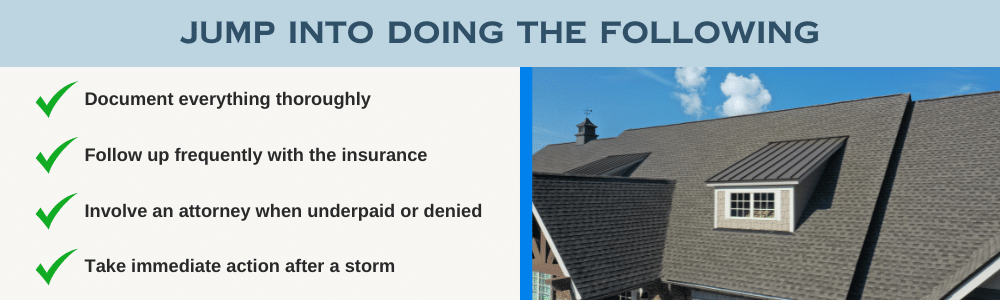

Let’s Discuss the Dos:

Do: Document Everything Thoroughly

Thorough documentation is essential when filing an insurance claim. After a storm, take photographs of the damage as soon as it’s safe. Capture all areas of your commercial property that have been impacted. Include your roof, windows, walls, and any interior areas where water has penetrated. Documentation creates a visual record that strengthens your claim.

Commercial property owners should also keep track of any repair or cleanup expenses. This can include receipts, estimates, and invoices for repairs. Insurance companies often request proof of damage costs before processing a claim. Starting this process immediately after the storm will make things easier down the road.

A Texas claim attorney can assist in ensuring you have the proper documentation. This includes gathering expert opinions if necessary. Legal guidance is helpful because insurance companies sometimes dispute the extent of storm damage. Having strong evidence on your side reduces their chances of denying or underpaying your claim.

Do: Follow Up Frequently with Your Insurance Company

Filing an insurance claim isn’t a one-time event. After submitting your claim, you must actively follow up to ensure it moves forward. Insurance companies may delay claims, especially during busy times like hurricane or hail season. These delays can leave you waiting for weeks or months without a resolution.

Keep regular contact with your insurance adjuster to check the status of your claim. Sending emails is often better than calling, as it provides a written record of communication. If your claim is being delayed without explanation, a property damage attorney can help. They know how to apply legal pressure to expedite the process.

Insurance companies may also try to dispute the cause of damage or argue that pre-existing conditions worsened it. Regular follow-ups show that you are serious about pursuing the claim. It also makes it harder for the insurer to justify unnecessary delays. If your claim feels stuck, don’t hesitate to seek legal support.

Do: Involve a Texas Claim Attorney When Claims Are Denied or Underpaid

Unfortunately, insurance companies sometimes deny legitimate claims outright. In other cases, they may significantly underpay, leaving your business short of the funds needed for repairs. If you find yourself in either of these situations, don’t give up. A Texas claim attorney can help you challenge the decision.

If your claim is denied, you have the right to appeal. An experienced attorney will review the denial, identify any errors in the insurer’s reasoning, and submit the necessary documentation to fight the decision. If the insurer denied your claim in bad faith, we will file a lawsuit on your behalf. Texas law protects policyholders from unfair treatment by insurers. A property damage attorney can help you hold your insurance company accountable.

For underpaid claims, attorneys can negotiate a higher settlement by presenting additional evidence or working with independent appraisers. They can also file a lawsuit if the insurer refuses to pay what’s owed. The goal is to ensure you receive the compensation your business needs to recover fully.

Do: Take Immediate Action After a Storm

Time is a critical factor in insurance claims. The sooner you file your claim, the sooner your business can recover. After a storm, assess the damage and notify your insurer as quickly as possible. Delaying this step can hurt your chances of receiving compensation. Insurance companies may argue that the damage worsened because you didn’t act fast enough.

In some cases, insurers may also argue that the damage wasn’t storm-related but was caused by pre-existing issues. Filing your claim promptly reduces the likelihood of this argument. Filing promptly shows your insurer that you are proactive and serious about resolving your claim.

If your insurer is slow to respond, a Texas claim attorney can help you move the process along. We will communicate directly with the insurer on your behalf to ensure they give your claim the attention it deserves.

Contact Stormlex Law Group

Due to the all too frequent and violent nature of storms that Texas is prone to, residents of San Antonio, Dallas, Austin, and other cities often experience significant property damage as a result. In your time of need and stress, you expect the insurance company to show up for you and your claim. That’s not always the case.

Negotiating with the insurance company can be a daunting and stressful task and Stormlex Law Group understands how essential it is to advocate for your rights and interests. Our insurance lawyers are prepared to present your case clearly and persuasively, using evidence and documentation to support your arguments.

Facing a denied insurance claim can be a challenging and overwhelming experience, but it’s important to remember that you have options and rights as a policyholder. By understanding your rights, gathering evidence, and seeking legal guidance, you can increase your chances of overturning the denial and obtaining the coverage you deserve.

If you are currently dealing with a denied claim, give us a call at 877-890-6372 or send us an email at info@stormlex.com