Protecting Your Rights After Wind Damage

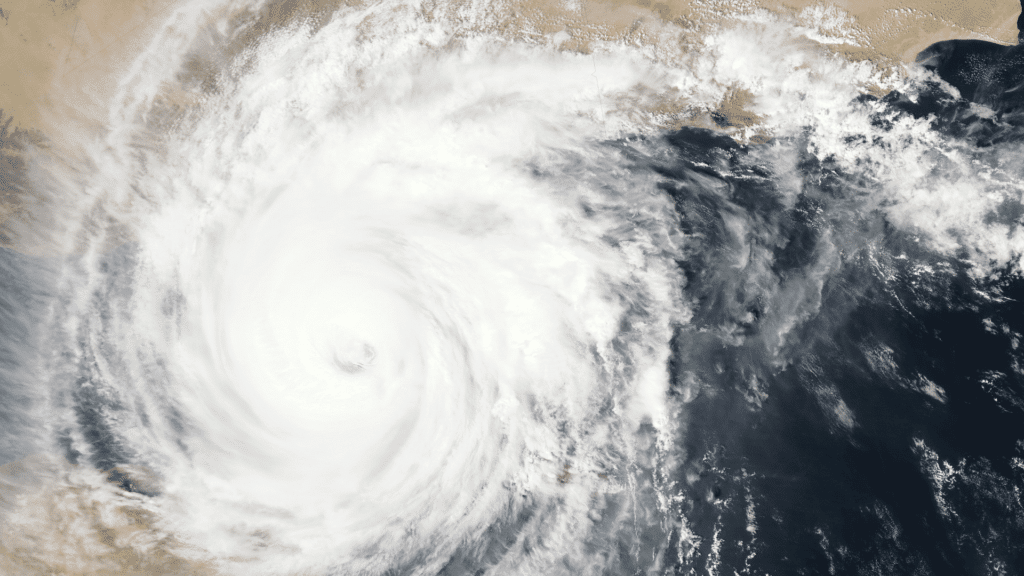

Severe weather events like storms, hurricanes, and tornadoes can result in wind damage to property. Understanding your legal rights is essential when seeking wind damage claims. You can secure fair compensation by documenting the damage, notifying your insurer promptly, understanding your policy, and seeking legal assistance when necessary.

Document the Damage Immediately

The first step after experiencing wind damage is to document everything. Take photos and videos of all damage to your property. Include photos of structural damage, broken items, and any debris caused by the wind. Be sure to take wide-angle shots to show the entire area and close-up images for clarity. If you have before-and-after photos of your property, these can support your insurance claim. Make a written list of all damaged items and estimate their value. Save receipts for any temporary repairs, such as covering broken windows or securing roof tarps.

Notify Your Insurance Company

Report the damage to your homeowner’s insurance company as soon as possible. When filing your claim, be prepared to provide documentation, including photos, videos, and receipts. It’s important to review your insurance policy. Understanding your coverage, including any exclusions or limitations for wind damage, can help you during the claims process.

Prevent Further Damage

Insurance policies typically require homeowners to take steps to reduce the potential for further damage after a windstorm. This may include boarding up broken windows, covering roof damage with a tarp, or securing unsafe areas. Your insurer may reimburse expenses for temporary repairs, so keep records of the repairs and any receipts. Avoid making repairs until an insurance adjuster has surveyed the damage. Removing evidence of the damage before it has been assessed can complicate your claim.

Understand Your Insurance Coverage

It is essential to review your homeowners’ insurance policy to understand the coverage for wind damage. In Texas, many policies include specific windstorm or hurricane deductibles, especially in coastal areas at higher risk of severe weather.

Dwelling coverage applies to repairs for structural damage to your home. If wind damages your roof, siding, or windows, this portion of your policy should cover repair costs. Personal property coverage is designed to reimburse you for damaged belongings inside your home. This coverage includes items such as furniture, electronics, and appliances.

In cases where wind damage leaves your home uninhabitable, additional living expenses coverage may apply. This can cover temporary living costs, including meals, hotel stays, and other necessary expenses while your home is being repaired.

It is important to review your policy’s exclusions and limitations. Some policies may not cover certain types of wind damage or impose stricter requirements in areas prone to hurricanes or tornadoes.

Know Your Rights During the Claims Process

Insurance companies are required to act in good faith when handling claims. This means they must investigate your claim promptly, communicate clearly, and offer fair compensation based on the terms of your policy. If you feel your insurer is acting unfairly, you may request written communication regarding the status of your claim. You also have the right to hire an independent adjuster or contractor to provide a second estimate of the damage. If your insurer denies your claim or engages in bad faith practices, you may file a complaint with the Texas Department of Insurance.

Explore Additional Coverage Options

Homeowners in high-risk areas of Texas, like San Antonio, Dallas, and Austin, may have a separate windstorm insurance policy through the Texas Windstorm Insurance Association (TWIA). This coverage is available for properties located along the Gulf Coast where private insurers may not provide windstorm coverage.

Be Mindful of Claim Deadlines

Texas law has strict deadlines for filing property damage claims. Insurers have 15 days to recognize a claim and request additional information. Once you provide the necessary documents, they have 15 business days to accept or deny the claim. If you decide to take legal action against your insurer, follow the statute of limitations. You have two years from the date of denial to file a lawsuit. Be sure to meet all deadlines to protect your rights.

Avoid Common Mistakes

To avoid common mistakes that may weaken your claim, gather documentation that clearly shows the extent of the damage. Insufficient evidence may result in a lower settlement or denial of your claim. Failing to complete the damage report promptly can impact the claim, as most policies require swift notification. Failure to report within the required time frame can lead to claim denial.

Accepting a low settlement offer without understanding the extent of your damage can be detrimental. Some insurers may propose a quick but insufficient payout. Seeking a second opinion from a contractor can provide additional information on the actual cost of repairs.

Neglecting temporary repairs can lead to additional damage, which insurers may refuse to cover. Taking steps to reduce further damage, such as covering broken windows or securing a tarp on your roof, demonstrates responsibility and compliance with your policy.

Stormlex Law Group Protects Your Rights

Has your insurance company denied or underpaid your wind damage claim? You deserve a fair insurance payout after wind damage. Don’t let insurers delay, undervalue, or deny your rightful claim. Stormlex Law Group is here to fight for you. We’ll negotiate on your behalf, handle complex claims, and ensure your home is repaired. Contact us today at 877-890-6372 for a free in-depth case evaluation. Let us help you get the compensation you deserve.