Homeownership brings joy and security. But it also comes with its share of risks.

Win Your Claims: A Property Damage Insurance Lawyer Guides You!

One of the most frustrating situations a property owner can face is having their insurance claim denied after experiencing damage to their property. As a homeowner, understanding your rights and the appeals process can mean the difference between financial recovery and added financial stress.

In Texas, property owners often find themselves in uphill battles when it comes to insurance claims. Denied claims, delayed payouts, and undervalued damages are all too common. But fear not! With the right knowledge and legal support, you can navigate these challenges and ensure fair treatment from your insurance provider:

- Understanding your rights as a property owner

- The appeals process

- Steps for maximizing your insurance claim

- How a property damage insurance lawyer can help

Your Rights as a Homeowner

As a property owner, you have the right to fair treatment from your insurance provider. This fundamental principle forms the cornerstone of insurance agreements. It implies that when you suffer property damage covered by your policy, your insurer should fulfill its contractual obligations promptly and adequately.

Insurance policies are legal documents filled with complex language and industry-specific terms. Each insurance policy is a unique legal document that specifies the scope of coverage, exclusions, deductibles, and claim procedures. Therefore, it’s important to review your policy carefully.

Another layer to your rights as a homeowner comes from your state’s (Texas for us!) insurance code. Now, you may not be up to date with all the codes and regulations. We don’t expect you to. That’s what our attorneys are here for.

Understanding key terms and how they apply to your claim can be difficult. At Stormlex Law Group, our property damage insurance lawyers specialize in interpreting insurance policies and advocating for policyholders like you.

Navigating the Appeals Process with a Property Damage Insurance Lawyer

When your insurance claim is denied, you need to know that you have the right to appeal the decision. This process often involves several steps outlined in your insurance policy. From gathering evidence to participating in mediation, appealing your insurance’s decision could mean a significant financial recovery for your claim. Each insurance company has its own appeals process, which can vary in complexity and requirements.

A property damage insurance lawyer is well-versed in the various appeals process. We can help you understand your rights and responsibilities, ensuring you meet all necessary requirements according to the type of coverage you have. Additionally, Stormlex Law Group can represent you in negotiations with your insurance company, advocating for fair treatment and maximum compensation.

Stormlex Tip: See our video about the legalities of denied insurance claims here.

Get Proper Compensation with the Help of a Property Damage Insurance Lawyer

Maximizing your insurance claim requires thorough documentation of damages and careful negotiation with your insurance company. We understand that you may feel overwhelmed or confused from the insurance jargon in your policy. Not only can a property damage lawyer assist you with understanding your policy, but can help you when appealing a denied claim.

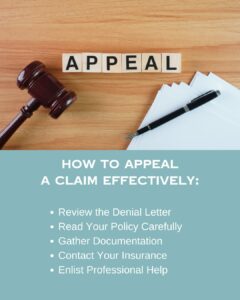

If your claim has been denied, we recommend following these steps with an attorney to ensure you get paid what you deserve:

- Review the Denial Letter: Understand why your claim was denied. Thoroughly read the denial letter and identify the specific reasons given by the insurance company.

- Read Your Policy Carefully: Identify any possible misinterpretations or errors. Compare the denial reasons with the terms of your policy to find any inconsistencies.

- Gather Documentation: Collect all necessary documents (policy, decision letter, contractor estimates).

- Contact Your Insurance Company: Clarify the denial reasons and express your intent to appeal. Have a detailed discussion with your insurer, asking specific questions about the denial.

- Decide if legal action is in your best interests: You greatly benefit from expert knowledge and representation when deciding to appeal your claim. Your attorney can not only handle the appeal process, but can also provide insight as to whether legal action is in your best interests as a homeowner.

How a Property Damage Insurance Lawyer Can Help You

Working with us can significantly increase your chances of a successfully recovered claim. Our professionals understand the intricacies of insurance law and can effectively negotiate with your insurance company on your behalf.

A property damage insurance lawyer specializes in advocating for policyholders facing insurance disputes. Our attorneys possess in-depth knowledge of insurance laws and regulations with several years of experience shared between them.

Insurance disputes can be a drag, especially when facing off against large insurance companies with teams of legal experts. A property damage insurance lawyer levels the playing field by representing your interests and fighting for the compensation you deserve.

Understanding your rights as a property owner and being denied after a claim can be complex and stressful. However, with the guidance of a property damage insurance lawyer, you can increase your chances of a successful outcome. By maximizing your insurance claim, you can secure the financial compensation needed to restore your property and move forward with peace of mind.

Stormlex Law Group

Due to the all too frequent and violent nature of storms that Texas is prone to, residents of San Antonio, Dallas, Austin, and other cities often experience significant property damage as a result. In your time of need and stress, you expect the insurance company to show up for you and your claim. That’s not always the case.

Negotiating with the insurance company can be a daunting and stressful task and Stormlex Law Group understands how essential it is to advocate for your rights and interests. Our insurance lawyers are prepared to present your case clearly and persuasively, using evidence and documentation to support your arguments.

Facing a denied insurance claim can be a challenging and overwhelming experience, but it’s important to remember that you have options and rights as a policyholder. By understanding your rights, gathering evidence, and seeking legal guidance, you can increase your chances of overturning the denial and obtaining the coverage you deserve.

If you are currently dealing with a denied claim, give us a call at 855-STORMS-4 (855-786-7674) or send us an email at info@stormlex.com

Featured Photo by Salohiddin Kamolov on Unsplash